Slater Technology Fund Year in Review

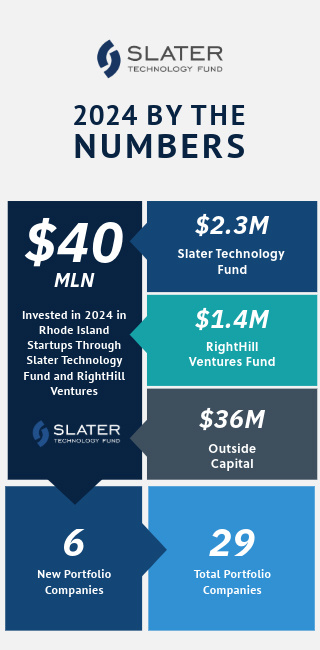

2024 was an exciting year for entrepreneurship in Rhode Island. Slater and RightHill Ventures teams worked at warp speed to keep pace with founders. Powered by a new contract to manage capital from CommerceRI, Slater posted over $2.3 million in ten companies and our sister fund RightHill Ventures added $1.4 million in private capital for a combined record year. Portfolio companies raised $36 million alongside our investments showcasing the power of seed-stage technology entrepreneurship. Margaret Hartigan’s FinTech company Marstone scored the largest round, an $8 million Series B, with bluetech start-up Flux Marine not far behind with its bridge round to its upcoming Series B raise.

Much of our 2024 investing was in life sciences (therapeutics and medical devices) and in women’s health where Slater is excited to have funded founders Melissa Bowley of Flourish and Penny Finnie from Egal. Investments in advanced materials, hardtech, AI, and consumer internet rounded out our commitments. We also continued our support for dynamic energy startups with grants for the CleanTech Open sponsoring EcoForge out of the Nelson Center’s B‑Lab and Tyler Ruggles new stealth startup CVector.

Here’s to sustaining the pace into 2025!

Maternal Healthcare

Maternal Healthcare

Slater joined the pre-seed round investing twice in FlourishCare, a pioneer in maternity healthcare services that connects expecting mothers with local parenting and baby experts such as doulas, who can dramatically improve the outcomes and cost of care. Founder Melissa Bowley has led the company’s creation, commercial launch, and rapid growth into the dozens of states now mandating these maternal services, now touted by CMS’ Transforming Maternal Health Model. Bowley, a veteran of local medical device developer Ximedica, developed her concept with strategic support from Slater partners NEMIC, and Rogue Women’s fund.

The Next Generation of Digital Simulation

The Next Generation of Digital Simulation

We’re proud to haqve made the founding investment for this scientific machine learning startup from the labs of Brown University’s legendary applied math professor George Karniadakis. The company launched in January with founder/CEO Adar Kahana and Executive Chairman William O’Farrell–a serial entrepreneur from Brown and veteran of five successful startups–and a $1 million investment from Slater and RightHill Ventures partners. Phinyx is expanding its team of AI experts and completing pilots and digital simulations that solve the toughest engineering problems.

Novel Treatment for Alzheimer’s

Novel Treatment for Alzheimer’s

Slater portfolio company MindImmune Therapeutics, on the heels of their successful Series B, has added as Chairman industry veteran Brad Margus, formerly CEO of Cerevance, Envoy Therapeutics and Perlegen Sciences. Based in the Ryan Institute for Neuroscience at URI, MindImmune has made a fundamental discovery that implicates the peripheral immune system in the pathology of Alzheimer’s disease.

“Pads on a Roll”

In October, Slater joined other seed investors in Egal’s oversubscribed Series A round which is powering the company’s accelerating go-to-market activities for pads-on-a-roll, the leading solution for progressive institutions addressing period poverty by publicly distributing a new category of menstruation products. Egal founder Penelope Finnie added yet another innovation award to her collection, taking top honors at the Women’s Health Innovation Summit (WHIS). Founded in Somerville and nurtured by Slater partner Social Enterprise Greenhouse, Egal is now building distribution across the United States and internationally following the legislation now mandating new services broadly.

Platform Technology for Moisture Control

Platform Technology for Moisture Control

Moisture control is key to everything from controlling mold in bathrooms to energy-efficient building design, food packaging, and comfortable clothing. Brown physics professor Derek Stein and his team are backed by RI investors Slater/RightHill Ventures, CherryStone Angels, and Adept Chairman Dan Cromie, who seeded the company in 2021 along with MassCEC. Adept just closed an over-subscribed $4.6 million seed round that included the top three US home builders as strategic investors and the firm is preparing to enter the market with its flagship moisture-control paint product next year.

Extracellular Matrix-Derived Biologics

Extracellular Matrix-Derived Biologics

Slater continued its support as lead of the seed round for XM Therapeutics, a biologics company hatched by Slater allies Brown Technology Innovations (BTI) with translational funding from Brown Biomedical Innovations to Impact (BBII). The company’s biological particles, grown from human stem cells, build upon the latest understanding of the matrisome — a family of proteins which bind cells into tissue. XM, with guidance from RIH hospital’s chief of Cardiothoracic surgery Frank Selke, is curating particles to address heart attack and pulmonary fibrosis. CEO Frank Ahman recently announced grant support from CommerceRI for their upcoming large animal trial.

Making Personal Events Easy

Making Personal Events Easy

We closed a $250,000 investment early this year in Restaurent, the latest venture from RI entrepreneurial “Founder & Friend” Nick Cianfaglione. The startup makes it easy to book and coordinate personal events at local restaurants and other meeting venues – think “Open Table” for the party after your kid’s graduation or your mom’s 90th birthday. Restaurent just closed a Series Seed investment in December to grow ARR and expand its already-active pool of 1,000 event venues.

Electrifying Outboard Performance

Electrifying Outboard Performance

We’ve loved the crusade that Ben Sorkin and his team embarked on to clean up (and quiet) boating since the first thrilling ride in an electric-powered inflatable back in 2021. With an expanding fleet of super-performant craft now available for purchase we invested in the midyear convertible debt round which helped the company with this Summer’s successful commercial launch.

Autoimmune & Inflammatory Celluar Therapeutics

Autoimmune & Inflammatory Celluar Therapeutics

In 2024, Slater led the first priced equity round for Octagon Therapeutics, a biotechnology company targeting autoimmune diseases and led by Brown university founders based on a discovery platform born in the labs of Brown University Health and Fred Ausubel’s lab at Harvard. Slater’s $500,000 in capital led a $2.35 million seed round, which powered the preclinical activities of this novel monoclonal autobody development venture.