Q&A with Lenoss CEO & Founder Dom Messerli

Ingenuity lies in simplicity. That’s Dom Messerli’s product development philosophy. Dom, who has many patents currently in use across spine specialties and ample experience transitioning napkin sketches to actual product sales, doesn’t like to complicate things.

Having worked in spinal medical devices for 30 years, most recently as a Director of R&D at DePuySythnes, a Johnson & Johnson Company, developing and commercializing products is part of Dom’s DNA.

While at DePuySythnes, Dom confronted staggering statistics: an estimated 1.5M vertebral compression fractures occur globally each year, with about 700,000 in Europe and the US. If not surgically treated, these fractures can lead to increased morbidity and mortality rates. Yet the current standard of care for these fractures is an epoxy-based solution which can leak out of the vertebrae into the bloodstream, heart and lungs, in as many as 1 out of 5 cases.

Fueled by a passion to fix this problem for patients and physicians alike through natural bone repair, Dom founded Lenoss Medical. The company’s product, called the OsteoPearl biological allograft implant, replaces the current, complex epoxy approach with an elegant, natural alternative. Instead of epoxy, the OsteoPearl is made entirely of allograft cortical bone, healing spinal fractures through a minimally invasive surgical approach using a clinically proven biological bone tissue.

We sat down with Dom to learn more about the OsteoPearl technology and its $600M market.

To start, can you give your elevator pitch for Lenoss Medical?

Lenoss Medical’s OsteoPearl allows spinal fractures to be treated with a biological solution for natural fracture healing, placing new bone where new bone is needed most. This treatment replaces epoxy, which carries potential complications.

What problem are you solving?

Osteoporosis – a common disease among the aging population that reduces bone mass and weakens bones – causes 700K spinal fractures each year that all require surgery. The standard surgical treatment, called Kyphoplasty, doesn’t physiologically heal the fracture or promote new bone formation in the vertebrae.

To make matters worse, the standard procedure – an injected synthetic liquid epoxy that hardens inside the vertebrae and remains in the body for life – carries potential risks. Since the epoxy is liquid, it can potentially leak into patients’ bloodstream, heart, and lungs.

In fact, there are over 40 published case presentations of patients who had to get open heart surgery after their spinal surgery to remove the epoxy from their hearts. Since our solution isn’t liquid, we’ve completely eliminated this leakage risk while also finding a way to naturally promote fracture healing of the vertebral body.

Can you share more about your thesis and process surrounding product development?

Of course. It’s exhilarating to commercialize an idea; seeing patients being treated in the operating room with a product your team developed is just immensely rewarding. As I’ve said over and over again: ingenuity lies in simplicity. This philosophy is extremely important across different areas, especially from a physician and patient perspective:

The simpler and easier a technology is for a physician to treat a patient, the better for patients.

In addition to product development, though, embracing simplicity improves business operations too. In particular, it streamlines supply chains and reduces manufacturing costs. It’s easy to make a complicated technology with an intricate supply chain; it’s so much harder yet exponentially more effective to design a simple product and process.

To do so, you and your team must constantly stop and consider how you can simplify because so many aspects of your business benefit from that, especially as you scale.

What was the most challenging roadblock you encountered while creating the OsteoPearl?

Our main challenge, which we continue to improve upon, has been producing higher volumes efficiently. Unlike metallic or plastic implants, our product is made of precious raw material: donated human tissue. We’re always conscious of its sacredness and keen to preserve it as best as possible.

To do this, we apply iterative design and general manufacturing principles to implement efficient fixtures and tools that produce high volumes without generating raw material waste. We also apply a lot of engineering innovation; every time we find a way to make our manufacturing process more efficient, we apply for a patent for that method.

Another, earlier challenge was licensing my innovation from J&J, where I worked when I came up with the idea for the OsteoPearl. Since J&J is a large organization, licensing proved complicated but with persistence, sound legal advice, and responsive communications from J&J, we were able to secure the license.

OsteoPearl is currently in commercial use – congrats! From your company’s founding to your product’s current state, can you summarize Lenoss Medical’s key milestones along the way?

- Receiving and attaining the exclusive worldwide license to our innovation

- Securing a partnership with MTF Biologics, a high-quality tissue bank

- Developing and patenting the surgical instruments to implant our technology

- Successfully performing our first in-human surgery

- Completing nearly 50 surgeries without any intravenous embolisms

Wow, nearly 50 surgeries and zero intravenous embolisms! Do you have any more information to share surrounding the success of the OsteoPearl?

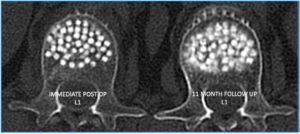

Yes! We’ve clinically validated that our implant performs the way we thought it would. In the image below, the graphic on the right shows an OsteoPearl implant after 11 months. The fuzzy parts around the edges reveal new bone forming where it’s needed most.

Curious to learn more about your target customers. Are they doctors and hospitals?

From a very high level, we have different customer categories. We are primarily focused on surgeons, both orthopedic and neuro, and interventional radiologists, who perform many of their procedures in an out-patient hospital environment

Some of our procedures are also performed by pain management physicians within a physician’s office. This latter group is increasing, mainly driven by reimbursement.

What other priorities are you currently tackling?

Continued Clinical Data Collection

We’re always focused on clinical data collection and are employing registry data collections for all new customers. While we have excellent clinical evidence of our allograft tissue use in orthopedic surgery, we want this data to be more specific to spinal fracture treatment.

Limited Strategic Sales

We’re also focused on limited sales or “market preference evaluation.” We’re scaling our sales operations to increase our footprint of first users and customers.

You’ve made some key go-to-market leadership hires this year. What does your current team look like?

We’ve been fortunate to hire talented, key contributors as consultants and now transition them to full-time as we close our current fundraising. In particular, we’ve hired three leaders with over 20 years of experience in their respective fields:

- John Williams – Executive Director for Sales Strategy and Operations

- Mike Landau – Vice President of Sales.

- Kevin Cooney – Executive Director of Marketing and Product Management

Lenoss Medical’s US market size is $600M with some significant historical exits. Can you share more about this market?

Yes, annual U.S. sales for treating compression fractures with epoxy are around $600 million.

The market size, though, has a tremendous opportunity to grow for two reasons:

- Physicians will treat more fractures with our more effective product; right now, they only treat 200K of the 700K annual diagnosed fractures likely due to potential risks and low confidence in the epoxy-based approach.

- The aging population is growing rapidly while also becoming more active so the volume of annual fractures will also increase.

The interventional spine space is also highly active and acquisitive. Almost every small company that starts in this space gets acquired. Medtronic acquired Kyphon for over $3 billion in 2007 and just recently, Boston Scientific acquired Relievant for $850M which is about 12 times their $70M in sales.

Since we’re the first and only company with a biological solution to treat these compression fractures, our exit potential is very promising.

What advice would you give to other medical technology entrepreneurs?

First and foremost, don’t do it alone.

Build a network of subject matter experts and partners, particularly those who can help with your regulatory, compliance, and reimbursement needs.

Most importantly, though, find a cofounder as soon as possible. I regret not doing this and highly recommend it because founding a medical device or life sciences company is highly complex. You need someone who truly believes in your mission and is passionate about your solution.

As an entrepreneur and inventor, you’ve cultivated a unique perspective. What everyday life advice can you share, professional or personal?

No matter where you are in your career, always take time to pause and assess it from a 30,000-foot view. Ask a simple question: Am I doing what I really want to do? Listen to your inner voice, focus on what drives you, and go in that direction.

Photo Credit: Ashley McCabe Photography